The Economics Association of Zambia –EAZ-has expressed reservations about the recent decision by the Bank of Zambia’s Monetary Policy Committee to raise the Monetary Policy Rate by 50 basis points to 14.0%.

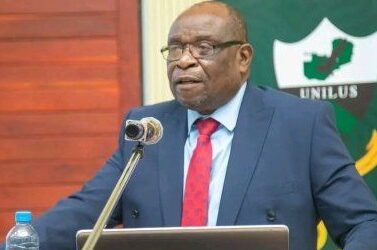

In a statement, EAZ Vice President Mbanji Milambo, observed that while the increase may help reduce inflationary pressures, it could have adverse short-term impacts on credit access and borrowing costs.

Mr Milambo says these effects could dampen economic growth by restricting access to credit for businesses and households, which in turn may hinder investment and production during a crucial period for Zambia’s economic recovery.

Mr Milambo has since called for a broader strategy that includes open market operations and other liquidity management tools, which would allow market forces to play a larger role in balancing supply and demand without overly burdening borrowers.

Going forward, the EAZ is urging the bank of Zambia to adopt a more balanced and holistic approach to managing inflation.

LATEST AUDITOR GENERAL`S REPORT REVEALS WIDESPREAD FINANCIAL MISMANAGEMENT IN LOCAL COUNCILS

The Auditor General's report on the accounts of local authorities for the financial year ended 31...

0 Comments